Crypto: Four Lessons Learned

After being the risk-asset poster child of the time and cash-abundant pandemic era, crypto assets have tumbled this year: the Blomberg Galaxy Crypto Index is down 63% (as of June 25), far worse than the Nasdaq (-26%), the S&P 500 (-17%) and the Bloomberg Global Aggregate Bond Index (-14%). Apart from th

e increasing recession and inflation fears that have rattled financial markets, the crypto universe has also been hit by several idiosyncratic events, namely:

- The recent collapse of the well-known Terra blockchain ecosystem: the company failed to maintain its peg to the US dollar – the key feature in any stablecoin (stablecoins are digital currencies that promise to be pegged to a major fiat currency in order to reduce volatility and gain market trust).

- Increasing liquidity and solvency issues: Major digital lenders Celsius Network and Babel Finance have frozen withdrawals; crypto hedge fund Three Arrows Capital faces liquidity concerns; CoinFlex, a crypto physical futures exchange, paused all withdrawals on its platform citing extreme market conditions and uncertainty involving a counterparty. Crypto brokerage and exchange Voyager Digital Ltd. also started limiting customer withdrawals and transactions.

While the subsequent sell-off has been indiscriminate, the crypto universe is still backed by Wall Street firms and leading asset managers, who continue to see the asset class as a source of both risk and opportunity. In order to find the latter going forward, investors may consider the following four lessons that the past few weeks have left us with:

- Crypto investing is about Finance: Some individuals invested in crypto assets to speculate or more because of the underlying technology than because of the assets’ risk and return profile. It is now apparent that, like any investment, capital flows into crypto assets should follow basic financial principles, including the fact that risk and return often come at the expense of each other.

Three Arrows Capital is having liquidity issues after over-leveraging its investments and therefore not being able to make margin calls when asset prices started to decline. Twenty-four years after the infamous collapse of Long-Term Capital Management (also caught in margin calls), risk management and operational due diligence practices have evolved and improved, raising questions as per why some professional crypto investors haven’t applied industry practice.

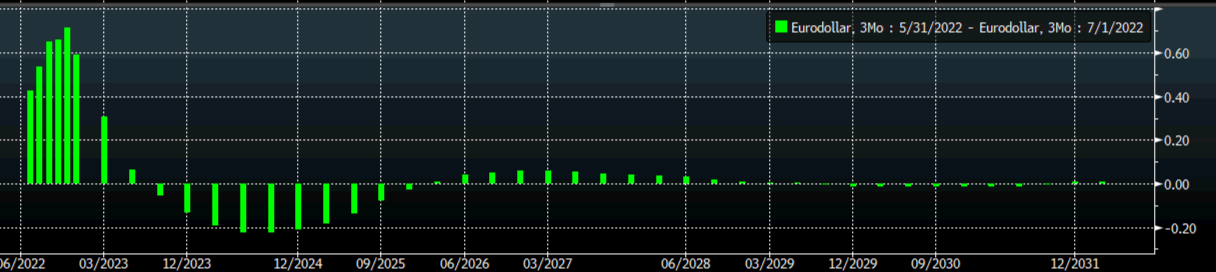

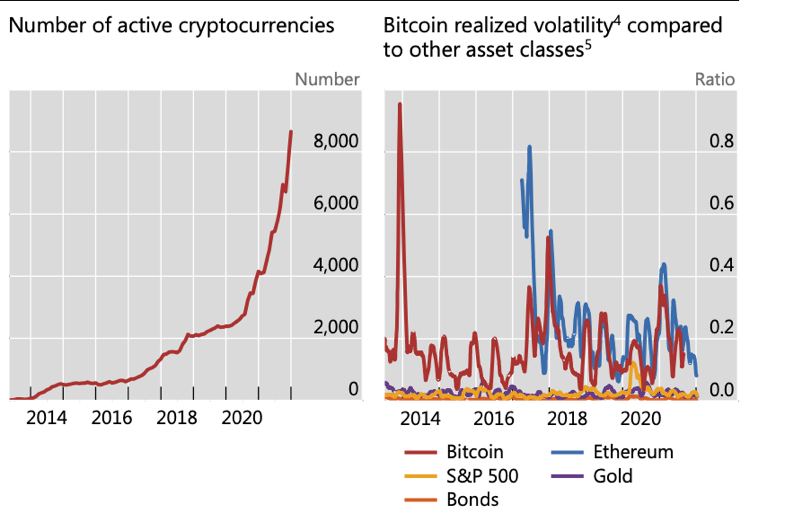

- Volatility, source of hedge fund alpha: As seen in Figure 1, the digital currency universe has shown far wider volatility than other asset classes, a feature also amplified by some crypto investors’ prominent use of social media. Also as seen in Figure 1, the exponential increase in the number of digital currencies has given investors a growing universe to trade in: crypto assets spiked to around $3 trillion last November, before plunging to less than $1 trillion at present (still a level similar to the entire US High Yield market).

Some hedge funds and other investors have turned this volatility and dispersion into opportunity, avoiding losses and offering investors uncorrelated returns. Crypto Market Neutral hedge funds have also offered a zero-beta exposure to tumbling markets so far in 2022, especially so in both May and June. Also seeking alpha, and in the midst of the sell-off, Goldman Sachs executed its first trade of Ether derivatives, just over a year after its first bitcoin derivative trades and a month after its first bitcoin-collateralised loan. Fidelity, JP Morgan, Wells Fargo, Bank of America, Mastercard, Amex and Alliance Bernstein are among the institutions that have also recently backed crypto universe.

Figure 1: Volatility attracts alpha-seeking investors

Source: Bank of International Settlements (BIS)

- More regulation is needed: As any new industry, the crypto world remains largely unregulated, something that has allowed disingenuous companies to hide relevant factors in the small print, mis-leading investors. Most professional investors seem to agree that a better regulated sector will be in the interest of all market participants. A recent paper by the bank of central banks (the Bank of International Settlements, or BIS) recently said: “Cryptocurrency intermediaries, including crypto exchanges, should be subject to the same types of regulation and oversight as intermediaries in economically equivalent asset classes, including with regards to financial stability, consumer and investor protection.”

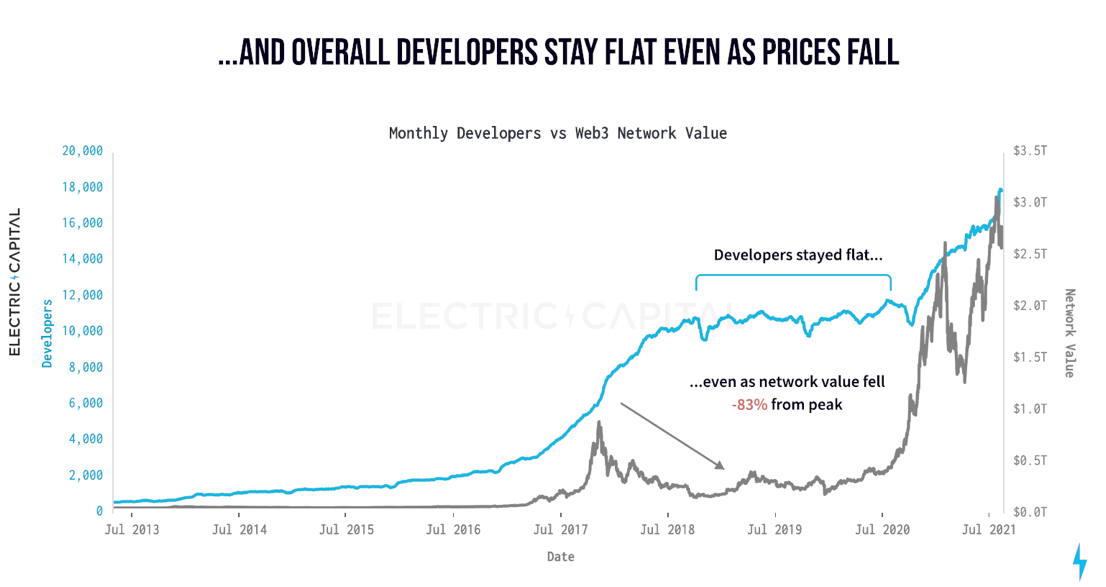

- Technology advance is unstoppable: Crypto currency companies are major developers of the blockchain technology, which initially focused on the verification of payments across the bitcoin network; the use now is far wider and crypto companies are more focused on the decentralisation of processes in multiple areas, including global supply chain management, clearing and settlement of financial instruments, insurance, telecoms… – the list is only growing. Progress never seems to stop – and neither seems to do the backing of: Figure 2 below shows that despite the price volatility in network values in late 2018 (hawkish Fed pivot) and 2020 (Covid), technology developers managed to hold their value.

Figure 2: Investors reward technological progress

The contents of these articles are not intended to provide investment advice and under no circumstances does these documents represent a recommendation to buy or sell a security or an offer to provide any of the services developed by AAM or its affiliates as disclosed in this website. The information and opinions set forth herein reflect the judgement of AAM of the subject issues under the prevailing conditions as of the date of these documents, and as such are subject to change. AAM does not undertake any responsibility for any reliance, which is placed by any person on any statements or opinions, which are expressed herein. Neither AAM, nor any the respective directors, officers or employees will be liable or have any responsibility of any kind for any loss or damage that any person may incur resulting from the use of this information.

Recent Insights

Thank you

for your email!

A member of our team will respond to you shortly.

COOKIES

This site may use cookies and other tracking tools to improve your experience on our website. By clicking “I Agree,” you accept the use of these tools in accordance with our privacy policy.

Click here to learn more