H2 Hedge Fund Outlook

In our 2021 year-end video we proposed 3 likely trends:

- Watch inflation- suggesting funds that are Macro-aware would likely prosper

- Hedge fund talent wars to persist- with Multi-Strat positioned to attract the best

- Diversification of alpha sources- achieved through traditional hedge fund strategies and some niche approaches

So far in the first half of 2022 saw a clear regime shift taking place in markets, as a result of rising persistent inflation and global Central Banks’ determination to stamp it out by raising rates aggressively.

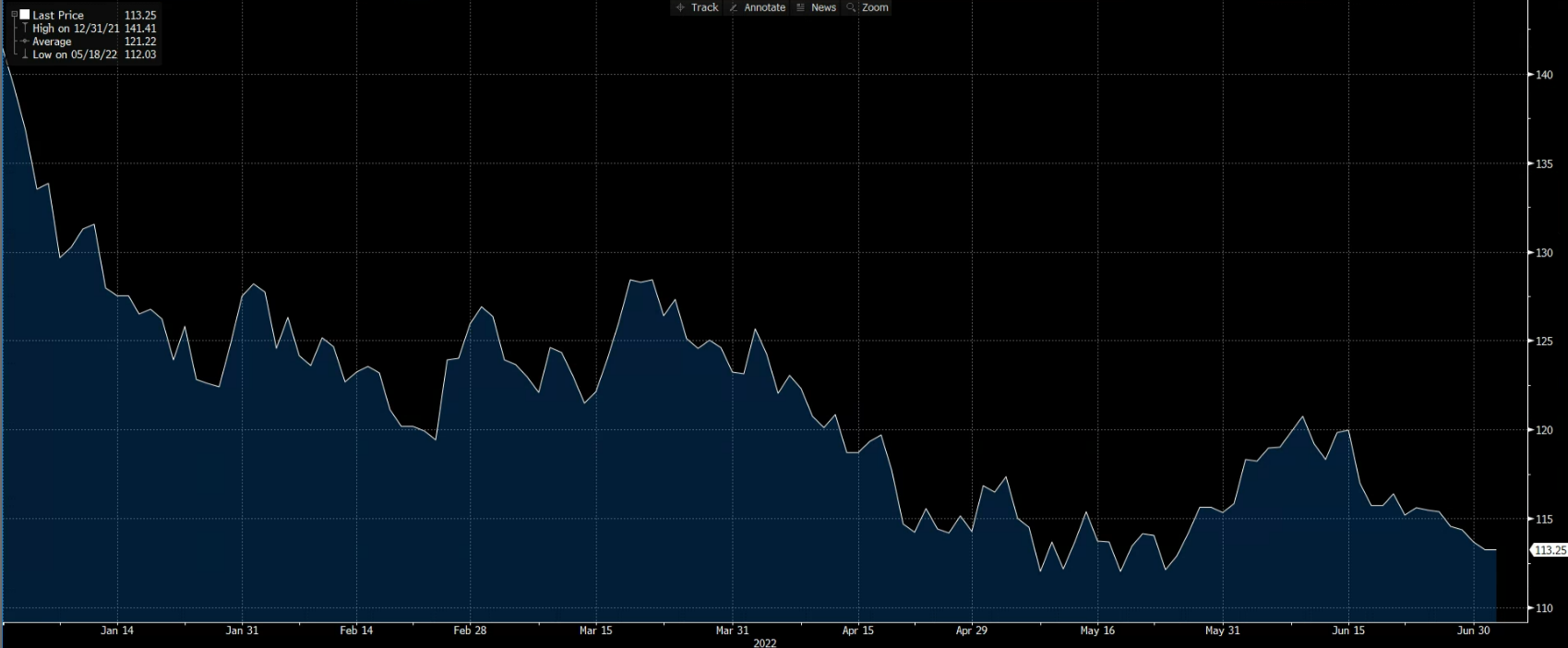

Figure 1: US 1Y1Y Forwards (Jul-20 to Jul-22)

Currently there is little appetite for long duration assets, especially in growth areas of the market, such as Technology and more recently in Crypto. There has been a violent rotation out of these assets at varying points of time during the year; suggesting diversification would have been crucial to mitigate losses.

Figure 2: US Growth Factor (Jan-22 to Jul-22)

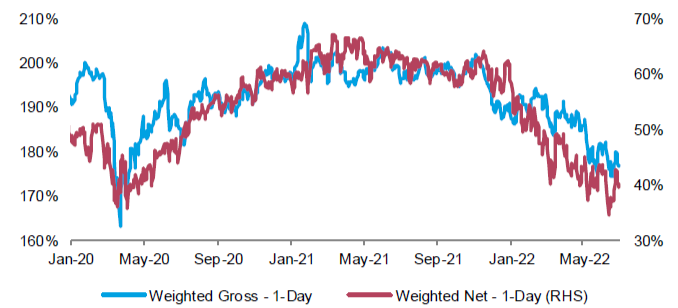

Leading to de-grossing across hedge funds and dispersion across strategies, as Macro, CTAs, and Multi-Strategy performed well; whilst LS Equity struggled.

Figure 3: Hedge Fund Gross and Net Exposure (Jan-20 to Jun-22)

Source: Morgan Stanley

Looking ahead to H2 and beyond

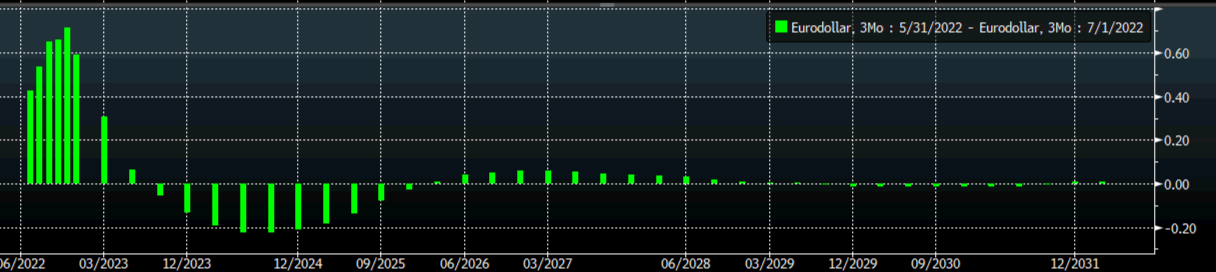

Markets are increasingly pointing towards a recession, to the extent we believe we are already in one. Often for the fundamental analyst the question is no longer: “are we in a recession?”. Rather it is one of: “how long and deep will the recession be?”. EuroDollar futures curve change from May to July suggesting more front-loaded rate hikes, but into the middle of 2023 rate cuts to alleviate these fears are expected.

Figure 4: EuroDollar Curve Change 31st May to 1st July 2022

What we are more certain of: elevated volatility, both at the single-name and index level, will persist with high levels of dispersion intra and inter-asset classes. Divergences will continue: both at the macro and micro-levels.

So where do we see opportunities in Hedge Funds?

Remaining in tactical nimble funds that are macro and factor aware continues to be crucial, especially in the near-term. We see value in holding:

- Macro- given a divergent profile that has been able to capture this regime shift

- Multi-Strategy- offering a high SR profile with truncated downside due to different risk management protocols at PM and fund level. Though as we know not all Multi-Strategies are created equal, please reach out to [email protected] for more details

Looking across other strategies:

- LS Equity- we expect to remain challenging; however see opportunities in funds which can keep their core DNA and alpha generating process intact, whilst adapting to the current macro trends such as through more nimble net/gross management

- Quant- remain focused on ML given their inherent adaptability being at the core of their process

- FI Arb- modest uptick recently in basis strategies given the volatility in rates markets

Finally, there is an increasing confidence that Converts and Credit will be able to prosper in the medium-term, given there is often a rich set of investment opportunities in downturns. The lessons from macro commodity cycles of the past, are that markets expunge excesses, bringing back discipline through a higher cost of capital. Identifying the survivors of the cycle is the key for those providing such capital. This is where opportunities arise in credit. Distressed thought process intertwined here also. Converts continues to offer a good risk-adjusted ability to profit from volatility and uncertainty.

The contents of these articles are not intended to provide investment advice and under no circumstances does these documents represent a recommendation to buy or sell a security or an offer to provide any of the services developed by AAM or its affiliates as disclosed in this website. The information and opinions set forth herein reflect the judgement of AAM of the subject issues under the prevailing conditions as of the date of these documents, and as such are subject to change. AAM does not undertake any responsibility for any reliance, which is placed by any person on any statements or opinions, which are expressed herein. Neither AAM, nor any the respective directors, officers or employees will be liable or have any responsibility of any kind for any loss or damage that any person may incur resulting from the use of this information.

Recent Insights

Thank you

for your email!

A member of our team will respond to you shortly.

COOKIES

This site may use cookies and other tracking tools to improve your experience on our website. By clicking “I Agree,” you accept the use of these tools in accordance with our privacy policy.

Click here to learn more