The Case for Commodities II

After analysing what Commodities can do for investors in the first article of our series, in this second part we will look at why now it may be a good time to enter into the strategy, and what potential risks investors may face – and how to counter them.

Commodities: Why now? We see three major factors:

1. Multiple thematics to trade: Although there are multiple themes driving Commodity markets, we currently see three major ones:

- Net-zero transition: As the world moves towards its United Nations-led carbon-neutral goal, governments, companies and individuals decarbonise to make the planet more sustainable. At present, fossil fuels generate about 80% of the world’s energy output, a figure planned to drop to 20% to meet the net-zero goals. This gargantuan change will require equally gargantuan investments in renewable sources of energy, such as solar, wind and tidal. Industries will have to shift entirely; cars, for instance, are in transition to become fully electric. The change will continue to generate winners and losers, offering alpha opportunities to investors who can not only see the direction of travel, but also the timing of change.

- Energy disruption post-Russian invasion: The West has declared an economic war against Russia, imposing sanctions and embargos, although this collides with its purpose to secure domestic energy supplies. For example, the embargo slated for December 5th has already seen Russia sending less crude to the EU, India and China. This disruption may transcend the war, given the undermining of Russia’s productivity and the de-grading of its assets from a technological perspective.

- End of globalisation: The shattering of supply chains as the world continues to be bent inwards on its own self has wreaked havoc on some Commodity markets at points in time.

2. Less competition for fundamental traders: Tougher regulation following the 2007-08 Great Financial Crises decreased bank’s presence in physical and financial markets, hampering many traditional players’ ability to execute their trading strategies. As a result, an astonishingly large number of fundamental Commodity funds closed between 2012 and 2018, including some of the biggest names in the business such as Blenheim, Armajaro, Centaurus, Clive, Jamison, Astenbeck, etc. This has resulted in less competition for active fundamental traders, meaning that they can, for instance, more easily extract alpha from something as simple as supply and demand forecast for inventories.

3. Large non-fundamental flows: Some of the largest market participants today, in terms of volumes, are non-fundamental funds – traders fully focused on the price moves of future contracts; as opposed to fundamental traders, these market participants have no view or interest in any underlying information on a particular commodity, or between commodities. By focusing on price, these traders find alpha by, for example, following the capital flows of macro tourists that buy commodities as an inflation hedge – paying a risk premia for it.

Risks

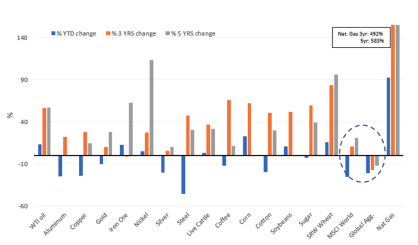

Volatility works both ways, as investors may enjoy the upside, but also suffer from potential downsides. Figure 1, for instance, shows this year’s double-digit losses in some commodities, such as steel, copper and aluminium – largely due to the recessionary outlook ahead. As seen in the chart, Commodity losses seem outsized relative to stocks and bonds – but so are the gains.

Figure 1: Commodities: for the good and for the worse

Source: Bloomberg as of 27 Sept. 2022

This is why at Antarctica we focus on funds that have solid risk management frameworks managing unbounded trades, or those without any fundamental limit, in either direction; for instance, this is as if US Natural Gas drew all from storage into March, before the injection season starts to properly get into full flow. In order to reduce risk, we also favour managers using scenario analysis, and not one that only uses historic cases, but one that also creates different, new and synthetic situations, as the future may bring scenarios not seen before. Investors may also beware narrative risks, or the self-serving stories spread by interested parties: for instance, there has been much talk about a Commodity Super-Cycle, mostly driven by reduced supply meeting increased, structural demand. While supply has been disrupted by the present war, it is also true that producers such as OPEC have cut output, and that the structural increased demand is hard to see given the weak global outlook ahead. Finally, we must be aware that Commodities, as a sector, is often prone to exogeneous, unpredictable shocks to the system. The most obvious example is weather conditions far outside the norm, such as a drought hitting the US in 2012 resulting in a spike in agricultural prices.

Conclusion

Commodities are a volatile, idiosyncratic asset class, traded by distinct market participants who seek opportunity in the thematic narratives and exogenous factors that drive the pricing saction. Both Fundamental and non-Fundamental strategies see in the sector’s traditional volatility an alpha rich sandpit, as they can take positions across the spectrum, given the opportunity set isn’t constant in any individual commodity or sub-sector.

DON’T MISS THE FIRST PART OF THIS SERIES: THE CASE FOR COMMODITIES I

The contents of these articles are not intended to provide investment advice and under no circumstances does these documents represent a recommendation to buy or sell a security or an offer to provide any of the services developed by AAM or its affiliates as disclosed in this website. The information and opinions set forth herein reflect the judgement of AAM of the subject issues under the prevailing conditions as of the date of these documents, and as such are subject to change. AAM does not undertake any responsibility for any reliance, which is placed by any person on any statements or opinions, which are expressed herein. Neither AAM, nor any the respective directors, officers or employees will be liable or have any responsibility of any kind for any loss or damage that any person may incur resulting from the use of this information.

Recent Insights

Thank you

for your email!

A member of our team will respond to you shortly.

COOKIES

This site may use cookies and other tracking tools to improve your experience on our website. By clicking “I Agree,” you accept the use of these tools in accordance with our privacy policy.

Click here to learn more